Silver Price UK

Over the last decade silver prices have been less volatile than gold and, with the exception of a huge surge in April 2011 when the price of silver in the UK reached almost $50 per ounce and remained at around $30 until April 2013, the price of silver has remained around the $15-$20 mark. Unlike gold prices, the price of silver is influenced by the mining of other commodities including copper. However, as a precious metal, it does (to an extent) follow the trend of gold prices. As a result, investing in silver is seen as a traditional bedfellow to investing in gold and further diversifies an existing investment portfolio. With the recent tumultuous activity of traditional paper assets, physical gold and silver is commonly being seen by many investors as a sensible way to create financial security by balancing an investment portfolio.

Ever wondered what would happen if stock and house prices plummeted? Take our FREE test now

Silver Prices

We provide regularly updated charts for the price of silver in the UK and you can also access historical records for the last ten years.

More commonly, silver is extracted from copper, zinc and gold ore and is therefore linked (to an extent) to the prevailing markets for these three metals. In very simple terms, all commodities follow the basic rule of supply and demand and silver is no different. As a precious and rare metal, silver has an inherent value that is rising in response to the growing realisation that silver resources are, not only finite but more limited than was originally estimated. Silver is also the most conductive and malleable metal available and has a number of uses in a variety of industries including photography, electronics and the growing photovoltaics market.

With its inherent antibacterial properties, silver is also widely used in the pharmaceutical industry. With many of these uses of silver being single-application and the metal not being recycled combined with a rising demand and finite supply, investment in silver is regarded as having good growth potential in the long term.

Other factors which influence the price of silver include:

- Global inflation;

- Currency markets;

- Interest rates;

- Indirect pricing of other commodities.

Due to silver production correlating to copper mining, a decline in the copper industry, notably with new house building, can influence silver prices.

The price of silver in the UK has a long history and underpins the current name of the British currency unit; one pound of sterling silver was originally equivalent to one British pound. And the silver price in GBP is not the only culture that has used this metal to derive their currency. There are 14 languages where silver quite literally translates as money. In Cantonese, the word for cashier translates as silver collector and during the Qing and Ming dynasties the word for money was ‘silver ounce’. In French, argent means both silver and money.

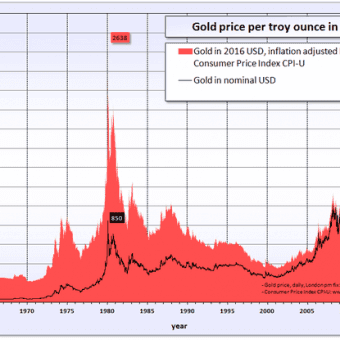

When global currencies began to reject the gold standard and move towards a flat currency, notably the U.S. in 1971, silver prices (and gold) began to rise. Famously, the Hunt Brothers (oil billionaires in the U.S.) tried to corner the market and created a huge surge in prices from a price of $6.08 per ounce in January 1979 to a high of $49.45 per ounce just 12 months later. Already holding around a third of the world’s supply of silver (net of government reserves), the brothers borrowed heavily to finance a sweeping hoard of silver. The impact on the market of inflated silver prices was met with opposition and the COMEX placed heavy restrictions on commodity purchases. The resulting drop in the price of silver caused a panic known as Silver Thursday which saw the price fall by 50% in just four days and left the Hunt Brothers unable to service their debts.

Whilst the recent silver markets have been less volatile, the silver price in the UK has seen some peaks over the last decade including the surge in 2011. A common reaction to falls in traditional economies, the rush to secure defensive commodities like silver and gold caused a spike in the price of silver from April 2010 of $18.65 per ounce to a price of $47.91 per ounce in April 2011.

You can buy more silver for your money with our tax free silver solutions, including silver bars, bullion and coins.

Here at Physical Gold, we can provide you information regarding the prevailing silver price per ounce and offer solutions for your investment needs. You can also stay up to date with factors affecting silver prices in the UK with our market news, information and tips blog.

How is the silver price determined

The silver spot price is based on supply and demand of 1 troy ounce of silver before being minted into a coin or bar. While it represents the price for immediate trade, the market participants strongly factor in future prices and contracts into the equation. This adds an element of future supply and demand to determine the current price.

How is the silver price manipulated

Many silver investors and analysts believe silver price manipulation exists, more notably to keep prices low, known as price suppression. The theory follows several possibilities. Some believe the central banks somehow control the prices. Others think large financial institutions use derivatives, namely ‘naked shorts’) to push prices lower. The huge discrepancy between paper and physical silver is another concern, along with the practice of leasing silver and falling COMEX supplies. The fact that several financial firms have already been fined in the past, coupled with the relatively small size of the silver market compared to gold, suggests that silver price manipulation is both possible and probable.

How to calculate the silver price

The spot silver price is an almost constantly moving target, based on supply and demand and anticipated future dynamics. This is quoted in US Dollars, along with the daily silver price fix, derived from an electronic auction. This price is then converted into Sterling to produce the £ silver spot price. To derive the silver price of coins and bars is more complex. A premium is added to the silver spot price to reflect production costs, desirability and rarity. The premium falls as higher quantities of silver coins or bars are sought. Most silver dealers will now quote live price, updated every 60 seconds, on their websites.

How to price silver coins

The price to buy silver coins is a premium over the current silver spot price, based on quantity purchased, type of coin and the market environment. The silver coin price reduces as more coins are bought and most online dealers will clearly display the price breaks. Silver bullion coins such as the Britannia which is mass-produced for investment, command a lower premium than limited edition, collectors, or older coins with historical value. In a buoyant market premiums to buy will rise slightly and vice versa when the market is dominated by sellers.

How much is the silver price per gram

The current silver price per gram is around 40 pence.

The live price can be seen at the top of the website. This is the live spot price of silver. It’s derived from the US Dollar spot price per troy ounce, then converted into grams and finally into Sterling. This represents a benchmark rate from where physical silver is priced from.

Why silver price is low

The silver price should be higher from a precious metals perspective, with gold vastly outperforming it. It should also be trading at a higher price from an industrial usage point of view, especially when compared to other commodities. Price manipulation is the most obvious answer. Warren Buffet profited from creating an artificial shortage in 1998 and now it seems JP Morgan could be controlling the price. With JP Morgan selling vast quantities of futures contracts, pushing prices lower is enabling them to continually accumulate silver at bargain prices. So far they’ve accumulated around 675 million ounces, 6 times the amount Buffet held in 1998. With a weakening Dollar, every other commodity has increased in value. Silver has been left behind, but when JP Morgan begins to unravel the manipulation, it’s likely to soar.

Why silver was high in 2011

The silver price doubled in 6 months by the time it reached April 2011 and $50 an ounce. The main driver of this steep price increase was the ongoing global credit crunch and bank crisis. After 2008’s mortgage market losses, 2011 threatened a European breakup with the ‘PIG’ members threatening bankruptcy. Silver prices benefited from safe-haven demand, combined with projections of silver shortages due to industrial usage of silver in the solar panel industry.

Why silver price will go up

The silver price is likely to rise from its current position as it benefits from two possible areas of demand. As the most conductive metal on earth, it’s the go-to choice for the electronics industry. In our technological age, constant increases in electronics will further increase industrial demand for silver due to its many uses.

With stock markets overdue a significant correction and Brexit likely to cause market disruption, the silver price will likely rise due to safe-haven demand. Investors fear losses during market downturns and switch their attentions to precious metals, pushing up prices of silver.

If the suspected silver price manipulation eventually unravels, there are projections that the silver to gold ratio will close from current levels of 80:1 to its long term average of 15:1, dragging up the silver price in the process.

When silver price will increase

The silver price will receive a huge boost when the current equity market bull run comes to an end. After 9 years of stock market gains, a market correction is now overdue. As a safe haven asset, silver will benefit from increased demand during a market downturn, pushing up its price. The precise timing of this is unknown, but recent job losses, high street closures and major company bankruptcies, suggest it will be in the next 12 to 18 months.

When was silver price highest

The highest natural silver price was in April 2011 when it reached $48.70, during the credit crunch and ensuing global recession. In Sterling terms, the peak was in the following July when prices hit £25 an ounce.

The silver price hit an all-time high in 1979/1980 of just under $50 an ounce. This was due to market manipulation by a set of brothers by the name of Hunt. They focussed on both physical silver and futures to artificially move the market in their favour. After missing a margin call in 1980, the price plummeted to $11 an ounce.

What makes silver price go up

Supply and demand make the silver price go up. As demand increases from industrial use and investment requirements, prices move up as supply is limited. Market sentiment also plays a role. If concerns over a global recession increase, then so does demand for silver, pushing up the price.

Silver futures traded on markets such as COMEX have a large impact on prices, with trading reflecting expectations of price increases or falls.

What was silver price in 1980

The silver price reached an all-time high of just under $50 an ounce in late 1979 and into 1980 after the Hunt brothers successfully cornered the silver market. They mopped up both silver futures and physical silver in an attempt to propel prices upwards. This soon collapsed in the spring of 1980 when the brothers overstretched and failed to meet a margin call. Prices quickly fell to $11/ounce.

What is spot silver price

The spot silver price is the price of silver for immediate delivery before being manufactured into individual bars or coins. The market is open (and the spot price fluctuates) on a near to 24 hour basis as silver is traded over-the-counter (OTC) rather than within set exchange times. In 2015 the London Gold Fix was replaced by the LBMA Gold Price which is a daily spot price fixing derived from an electronic auction.

Download our 7 step cheat sheet to buying silver at the best price here

What about silver price in future

Over the long term, silver has proved to increase in value, albeit with spikes and troughs along the way. With its current undervaluation, especially compared with the gold price, it is more likely to rise from its current price than fall. The extent of future price rises will depend on the timeframe, industrial demand, the global economy and whether price manipulation is unwound.

What is the silver price forecast

Silver price forecasts vary dramatically from analyst to analyst. Some predict silver’s price to lose some ground in 2018 and tread water for the following years. Others believe price forecasts for silver are bullish with its undervaluation being realised with strong price increases. More visionary market participants predict massive silver price increases due to unforeseen events caused by the rapidly evolving digital age and our growing exposure to intangible risk.

What is sterling silver price

The Sterling silver price is around £12/oz as at mid-2018. This spot price of silver is a benchmark from where various physical silver items are priced. Higher quantities of silver coins and bars can be purchased closer to the benchmark silver price than single items. Silver coins and bars are sold close to the spot price.

How low can silver price go

The silver price could continue to fall for an indeterminate period. Much of the silver found comes as a by-product of mining for alternative metals. With continued supply, sentiment could push silver towards £11-12/oz. However, the silver price can never fall towards zero like paper assets due to its intrinsic value. As a physical metal, there will always be a price the market will pay for silver, especially with its many industrial uses. The current digital age continually produces new electronic demands of silver which will prevent the price falling too low.

How high can silver price go

It’s very possible that the silver price could go considerably higher to levels of $100 an ounce or more. It’s current ratio to gold signifies that its price has huge upside potential and represents very good value. Suspicions of JP Morgan controlling the market could prevent the price reaching these highs, but similarly, the current price suppression could be unwound, propelling the price skywards.

With its unrivalled conductivity, the silver price could be propelled upwards with increasing industrial demand for silver. Some analysts predict silver could reach incredible highs of $300 or $500!

Will silver price keep dropping

It’s possible that the silver price could fall further from its current level. There’s no fixed ‘floor’ to the price, so in theory the price of silver is free to fall and rise with supply and demand. Most analysts, even those bearish on silver, only anticipate a limited potential fall to around £11/oz. However the upside potential is huge with many market participants expecting silver to increase by multiples of its current price.

The biggest factor protecting the silver price from dropping too much is its tangible nature. Unlike paper assets like stocks, which can be deemed worthless overnight, physical silver benefits from an intrinsic value which prevents it ever becoming of no value.

Silver price without manipulation

It’s difficult to predict ‘what ifs?’, but a majority of silver buyers and sellers suspect the price is artificially low, in the same way it was manipulated upwards in the late 1970s. The silver market is far smaller than its gold counterpart, so scope for manipulation is high.

On a simple calculation, if silver was to naturally trade at it’s historical ratio to gold of around 15:1, then its current price would be around £60/oz, a 500% increase on its current ‘manipulated price’.

Silver price vs inflation

The dynamic between silver and inflation has evolved over time. For the first 175 years of silver price tracking, its value remained relatively constant as it was predominantly controlled by Western Governments as it was the preferred choice for coinage.

This has changed over the past 50 years as only small quantities of silver are now used in currency, while fiat money supply has increased at far greater pace than actual economic growth. During this period silver hasn’t consistently kept pace with inflation and has witnessed periods of declines, non-movement and spikes.

Silver price vs copper

Silver currently trades around 5 times higher than the copper price. The two don’t trade completely together so this ratio can vary over various periods. Bothy are used industrially and frequently both are mined together, with silver discoveries occurring as a consequence of copper mining.

Silver price vs bitcoin

Bitcoin has only been around for a handful of years so the silver price can only be compared for a short period. Clearly in the past 5 years Bitcoin’s price has risen exponentially while silver has floundered.

Silver is frequently compared to cryptocurrencies. Both assets are similar that markets believe they have huge potential price upside. In that way, they are both relatively high risk, high reward choices. The major difference is that Bitcoin’s value is intangible so it could fall dramatically, even to zero. In comparison, silver benefits from its intrinsic value, it can be physically used in industry, so its price is far more stable.

Silver price vs stock market

Generally, both stock markets and silver prices will rise over the long term. Recent years have witnessed tremendous stock market growth, coming soon after the 2008 credit crunch and global recession. In the same period, the silver price increased dramatically 2010 – 2012 and has fallen away somewhat since.

Rather than considering silver and equity markets as two mutually exclusive asset classes, we feel both can work in tandem. All assets experience cycles so by owning physical silver and stocks, the downsides can be diluted, with silver performing well when stocks flounder.

Most analysts anticipate a stock market crash in the next year or so, which would likely propel precious metals prices skywards.

Silver price vs oil

Generally speaking, the silver price will rise with the oil price. With many of the oil producing nations being situated in areas of conflict, an increasing oil price is sometimes a reflection of rising political tensions. Safe havens such as silver and gold tend to benefit in such circumstances, with increased demand pushing up the price of silver. High oil prices can also increase inflation and put pressure on global economies due to higher transport costs. Both can boost silver prices.

Clearly, this isn’t a hard and fast rule, but more a common occurrence.

Silver price vs gold ratio

One of the most talked about aspects of the silver price is it’s changing ratio to that of gold’s price. The fascination of this ratio stems from a significant change in recent years, coupled with the knowledge of the history of silver investment that the price ratio has been steady for decades previously. Both suggest that silver is significantly undervalued.

As of 2018 the Sterling Silver to gold price ratio stands around 80:1. This compares to an average of 47:1 over the past century and a modest 15:1 historically.

Silver price vs us dollar

Silver’s price is far more erratic than gold’s, so its comparison to the US Dollar is more difficult. While the silver price has witnessed extreme peaks and troughs, the Dollar has steadily depreciated as more money supply has weakened its value.

As a store of wealth and hedge against a declining Dollar, gold represents a more obvious choice, while silver offers higher risk takers the opportunity for higher returns.