Blog

How Much Is a Gold Bar Worth?

One of the questions we hear regularly, particularly from investors who are new in the gold business is one touching on the worth of a gold bar. In a bid to answer this question comprehensively, we will explore all the factors that directly affect the value of a gold bar.

Gold bars aren’t all worth the same

Before we begin, it is worth noting that all gold bars cannot cost the same. Even those that have similar weight and size may not necessarily have the same value. Also, worth noting is that the price of gold bars keeps changing each day that markets are open in accordance with the gold spot price.

Read the Ultimate Insiders Guide to gold bar and coin investment. FREE pdf

Factors that determine the value of a gold bar

1) The current spot price of gold

Since the gold bar is just a piece of precious metal, it makes sense for the going price of gold to determine its value. The gold spot price tells buyers about the market’s dollar value of one troy ounce of pure gold. Visitors to our site can always see the latest spot price at the top left-hand side of our web pages.

It is important to keep in mind that the gold spot price varies from minute to minute when the market is open, and also after hours in the Asian markets. After knowing the latest spot price of gold, you should then proceed with the following steps to know the value of a gold bar.

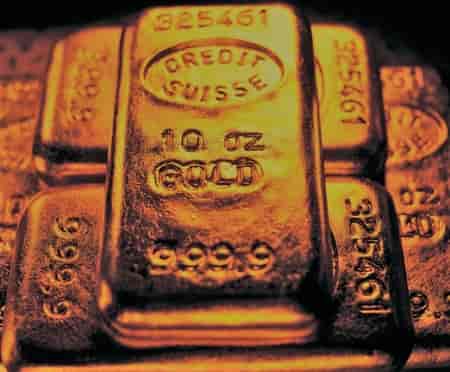

2) Weight and purity

After knowing the current price of gold, you should proceed to know more about the

purity and weight of the gold bar. Typically, manufacturers stamp purity and weight details somewhere on the gold bar – either at the back or on the front.

For the most part, gold bars are either .9999 or .999 pure albeit some brands may be .995 pure. If a buyer comes across a gold bar devoid of this information, it might not be real gold. Copper and bronze are common alloy metals that resemble gold in appearance. On the other hand, gold bar weights vary dramatically from about one gram to 1 kilogram. So, the size may affect the pricing as well.

3) Gold bar melt value

After obtaining the information about the purity and gold spot price, buyers should take gold bar’s weight (in troy ounces) and multiply that by the purity. The result will be the bar’s total pure-gold weight. After that, multiply the result by the gold’s spot price.

For example, if the gold bar weighs 10 grams (or 0.321507 troy ounces), and the gold spot price is $1250 with the purity of .9999, the gold bar value will be:

[0.321507 x .9999] x $1250 = $401.84Therefore, in this case, the value of pure gold in the 10-gram gold bar is $353.62. This doesn’t include the premium, which is the cost above the melt value that the gold bar might sell for.

4) Premium

A premium refers to the price added to the melt value of the gold bar. Calculation of the premium depends on many factors. Often, the demand and cost of production are the main reasons a gold bar may sell high and above the spot price. Premiums may vary depending on the gold bar’s weight, manufacturer or condition. It is usually indicated as a dollar value or percentage. Typically, as the gold bar’s weight increases, the premium will reduce.

So what’s the best value gold bars when buying?

The price you pay for physical gold will generally reduce as you buy more. In the case of gold bars, if you calculate the price per gram, larger bars are far better value than small gold bars. Infact any gold bars below an ounce in weight are really not great value due to the high production cost. Most new small bars will be beautifully manufactured to include being encapsulated in a plastic cover, complete with certification. In comparison, similar size gold bullion coins such as Sovereigns (7.32g of pure gold), can be bought at lower premiums as they’re sold loose. 100g gold bars offer decent value, with 250g and 500g slightly better again, and 1kg trading pretty close to the underlying spot price.

Watch our related video – “How much is a gold bar worth?”

So 1kilo bars are the best for worth?

The problems with 1kg gold bars are that many people can’t afford to invest £30k+ into gold at once and secondly, it limits flexibility. After all, if you buy a 1kilo gold bar to reduce the cost as far as possible, then you can’t liquidate £10k worth of gold if you need to. You’re forced to sell the whole bar or nothing at all.

An alternative method to buy gold bullion at the best value is to approach quantity discounts in another way, depending on how much you have to spend. While 1kilo bars undoubtedly offer the best value, discounts are still available for buying a quantity of more modest sized gold bars. Instead of buying one 1 kg bar, it could provide a good compromise to buy 10 x 100g bars instead. Buying ten 100g gold bars at once will enable you to receive a discount (although not quite as cheap as 1x1kilo bar), but still maintain a degree of divisibility so you can sell some of your holdings if needed.

5) Does brand matter in worth?

When buying gold bars, then the worth absolutely varies according to which brand bars you purchase. Brands such as Umicore tend to be priced slightly lower than Swiss brands such as Pamp, which command a premium. However, the importance of brand diminishes when you look to sell. Certainly, we’d pay the same for a gold bar regardless of its brand. We simply base our price on the gold price, weight and purity. So unless you especially want a Swiss brand for ego, prestige or as a present, buy the cheapest bar possible. Its value will be the same when it comes to selling. We sell pre-owned gold bars which are amongst our best sellers to savvy investors who realise brand shouldn’t impact a gold bar’s worth.

6) Value of gold bars versus coins

If you’re interested in gold as an investment, then there are two main types of physical gold to consider. Gold coins and gold bars. As long as these forms of gold are at least 22 carats in purity, then both are exempt from VAT. Other types of gold like jewellery, gold dust, lower purity coins, etc, will attract VAT and so are less attractive as effective investments. Generally speaking, your gold bar will not be worth quite the same as the equivalent weight in gold coins. The value of both tracks the factors already discussed. However, gold dealers will likely pay you very slightly more for desirable bullion coins such as Sovereigns than a gold bar. This reflects that the British coins are Capital Gains tax free and can be sold into a number of potential buyers due to their modest size. Certainly larger gold bars will usually be sold back into wholesale, so premiums are slightly lower to reflect that. We’re not talking a big difference, but perhaps a percent or so, depending on the market.

Download our FREE 7 step cheat sheet to successful gold investing here

..and how about the worth of gold bullion versus older coins?

The bigger discrepancy will be when comparing the value of a gold bar with the equivalent weight in a more numismatic coin. If you look at the value of a Victorian gold Sovereign, for example, its worth is not only based on its gold content but also it’s age, scarcity and desirability. For that reason, the value of a gold bar will always be lower per gram. The value of gold bars will never outpace the general gold price as they don’t contain historical or collectable value. However, gold bars would have been cheaper to buy in the first place.

Will tax affect my gold bar’s worth?

While UK coins issued with a face value, such as Britannias and Sovereign coins, are Capital Gains tax free, gold bars are not. That means the value of your gold bar could be impacted by tax. Obviously, if you sell your gold bar below the price you paid for it, then CGT will not have any impact on the gold bar’s worth. Similarly, if you’re gold bar has risen in value, but by not more than the annual CGT threshold (around £12k per annum), then no tax is applicable, and the bullion’s value is straightforward. However, for the larger investor, selling a considerable amount of bars at once, at a profit exceeding your annual £12k allowance, will incur tax, and therefore reduce the overall sale value of your gold bar.

One way around this for sellers of larger quantities of gold bars is to sell some bars before the April 5th tax year and others after the tax year. Spreading profits over two years, ensuring gains are below annual allowances will mean no tax. This strengthens the argument for buying lots of medium sized bars instead of very large bars which may incur CGT.

7) Timing

Obviously, the underlying gold price affects the

Firstly, the general market sentiment and supply/demand dynamic can impact the value of gold bars. That’s because the premium or discount to the spot price can vary according to how busy the market is. When the gold price rises, demand for gold increases and the number of sellers reduces. In this scenario, premiums to buy gold bars can increase to reflect the robust demand and prices paid to buy back gold also increases.

The opposite is true when the gold price is in a period of downside. Fewer buyers mean that gold bars may be snapped up at slightly lower premiums, while dealers may pay a percent less for your gold bar if you’re selling as there are an increased number of sellers.

What can I learn from this?

To maximize your gold bar’s value, buy when the market is quiet (and low) and sell when the market is on fire (even though everyone will think you’re mad!).

Secondly, the value of your gold wafer or bar can be based on either the live gold price or one of the two daily fixings. This may sound like a moot point, but it’s important to understand that in a volatile day, perhaps when important economic figures are released or interest rates increase, the price can vary greatly from morning to afternoon. So if you’re seeking to sell your gold bar, make sure you agree if you’re basing it off the live price, the morning fix (10.30am) or the afternoon fix (3 pm), as this can greatly impact your bar’s worth.

Buy Gold Bars directly from us

Now that you know how to determine the value of a gold bar, why not contact us to buy gold bars of the weight you want? You can call us on 020 7060 9992 or send us an email through our contact page, and we will be glad to serve you.

Image Credits: Public Domain Pictures and Hamilton Leen