Paper Gold

As the market continues to resist all sorts of financial risk – the question that keeps coming up is – How to buy gold bullion? People tend to be less attracted to gold shares or “paper gold” especially given the counter party risk prevalent in such securities. That being said – those that do opt for this avenue tend to do this either through a share dealing service provided by a bank or a financial intuition’s managed service where clients pay a management fee for the facility. In both instances clients have to pay Capital Gains Tax on any growth that they incur from holding their paper gold.

Owning paper gold may have a number of other disadvantages as well. Investors usually turn to gold in order to hedge their risks against volatility in the global stock markets. Since paper gold is linked to gold mining stocks, it defeats the very purpose of hedging. Mining stocks depend on spot prices of gold in order to forecast profits. So, when gold prices are sluggish, paper gold stocks do not invest in new supply locations, as it may not be profitable. In fact, gold stocks may sell physical gold at these times. This can create further problems for owners of paper gold, as the paper is useless if there isn’t enough physical gold to back it up.

Read our 7 step cheat sheet revealing the best way to buy gold bullion and profit. Download FREE

Spread Betting

We have spoken to people who have made and lost a lot of money by “spread betting”.

The term almost defies the very point why people buy physical gold in the first place – to minimise risk and to protect ones wealth. It’s a form of gambling whereby the winnings and losses are extreme and people can bet on things like who will win the next primary elections to what will the weather be like tomorrow. This sort of gambling is not for the faint hearted. Be prepared to lose but hope to win!

Here’s the deal

It is a speculative way of investing that is risky and used only by tactical investors who want to short sell their positions. These decisions are driven by predictions derived by investors who wish to time the stock markets and believe they know which way the markets are likely to move on a daily basis. A large number of investors lose money by trying to speculate in this way, while spread betting companies make their money on dealing charges as investors continue to place bets.

Savvy investors invest in the gold market backed by solid research conducted by market analysts. They usually have a clear strategy and know when they want to enter the market, as well as exit. In the absence of a concerted strategy, spread betting is simply a gamble and any trades you make can be impacted by market movements. If you are unable to pull out in time, you will lose your money.

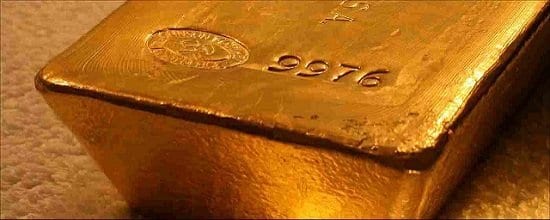

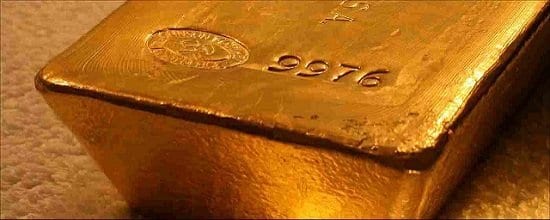

Physical Gold

The safest way to buy gold bullion is to buy the physical stuff, expect lower prices for bulk purchases. In doing so, you eliminate counter party risk and control your own wealth. The added benefit here is that you can purchase tax-free gold including gold Sovereigns or gold Britannias. It does what it says on the tin – it removes any Capital Gains Tax upon sale thereby allowing you to keep all of your growth.

In 2000 – VAT was made exempt to the purchase of physical gold and since then demand for physical gold relative to paper gold has soared.

Unfortunately – physical gold is unregulated so you have to take care when selecting who you purchase your gold from. You need consider the best place to buy gold bullion, ensuring that the company is BNTA (British Numismatic Trade Association) regulated and has a viable and proven track record.

Some people buy and sell their gold on eBay. This method isn’t hugely recommended as there is no way of proving the authenticity of the gold before you buy it. People often get stung this way.

People also buy directly from the Royal Mint. . Their website is excellent and showcases each and every coin immaculately however they tend to be considerably more expensive than gold dealers like us.

As the reliance on technology has increased over the years – people are able to conveniently find reputable companies online that specialise in selling gold. Some of these companies are merely gold sellers and won’t offer you any recommendations or guidance.

How to buy gold bullion to meet your objectives

We are an investment company and therefore have a vested interest in our clients growing their portfolio. We therefore take more of a consultative approach with our clients to ensure that they have all the answers before making any decisions. The question “How to buy gold bullion” can be different from investor to investor. We maintain the relationship from when they buy until when they choose to sell. We are also distributors of the Royal Mint and as a result our prices are far more attractive.

So if you’re considering investing in gold, the best method is to buy real physical gold coins or bars through a reputable dealer. Call us on 020 7060 9992 or drop us an email and our experts will be in touch with you to guide you on the best way to invest in gold.

Image Credit: Bullion Vault