Blog

How can gold protect you from Capital Gains Tax increases?

Rumours of significant Capital Gains Tax increases have spooked the investment market. But gold could be the answer to shield you from imminent tax rises.

UK’s rising debt

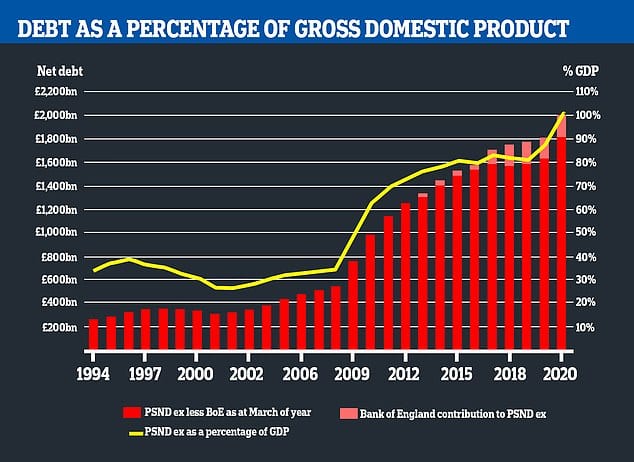

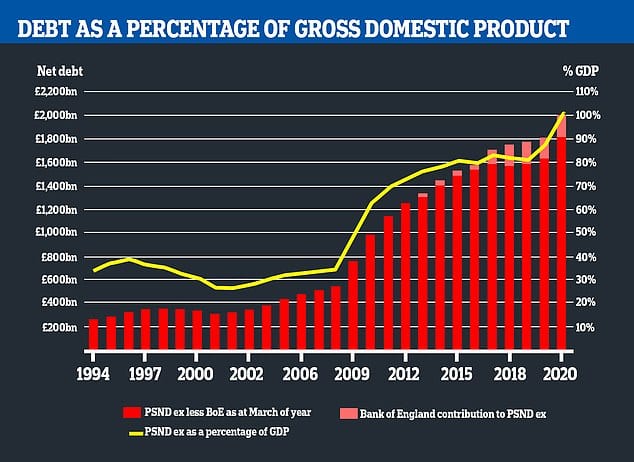

Getting the UK’s burgeoning debt under control has been a primary focus for recent Conservative Governments. Austerity measures have aimed to reduce UK PLC’s growing debt problem, despite its impact on large swathes of the population. UK Public sector debt (excluding public sector banks) has now exceeded £2 trillion for the first time. July’s level of £2,004 billion was a staggering £227.6 billion more than at the same point the previous year.

Furlough scheme extended to March and beyond

Chancellor Rishi Sunak has been praised for his speedy and decisive response to Covid-19’s impact on individuals and companies to work. A wide-reaching Furlough scheme has targeted those unable to work due to Covid-imposed restrictions. The scheme has evolved both in breadth, to cover more sectors like the self-employed, and in duration. Initial timeframes have been extended as we’ve entered the inevitable second wave of the virus and another national lockdown.

Need to tackle growing Government debt

But for a Government so focussed on balancing the books, this vast sum of debt has put a massive spanner in the works. Debt as a percentage of GDP has now reached parity after levelling off at around 80% from 2015 to 2019. With the virus still raging and furloughing in full swing, the chancellor has already turned his attention to ways of reducing this mind-boggling national debt from next year onwards.

Experts suggest Capital Gains Tax could be key to reducing debt

The Institute for Public Policy Research has recommended raiding middle-class investors and entrepreneurs to help plug the leaky public finances.

Reducing or abolishing the Capital Gains Tax (CGT) tax-free allowance would increase the number of people paying the tax by up to 300%, plus the amount paid by those already affected by CGT.

The Treasury calculates that CGT could raise a whopping extra £90 billion over 5 years if aligned with income tax brackets. The tax is levied on gains made on sale of shares, second homes and the sale of businesses. But an annual tax free threshold of £12,300 means that many people escape the tax altogether due to modest profits, while shrewd investors can split sales across tax years to minimise impact.

Part of the planned changes would see this threshold reduced or even scrapped. Estimates are that reducing the allowance to £5k would double the number of people paying the tax and reducing to £1k would triple the amount.

Owning physical gold coins can reduce your tax bill to zero

As an investor or business owner, it’s important to take pro-active action to prepare for possible tax increases next year.

Whether you’re buying as an individual or from company profits, gold’s popularity as an investment has hit new heights in 2020. Primarily enticed by healthy returns in the gold price, investors are now also recognising the tax free benefits of certain gold coins.

Which gold coins are tax free and why?

While all investment grade gold is VAT exempt, only certain gold qualifies as CGT free.

As a UK investor, selling gold bars or non-UK gold coins at a profit, could incur CGT if you make more than your allowance. But sticking to UK legal tender gold coins will mean any profits are completely free from CGT.

That’s because HMRC cannot tax individuals for gains made from selling its own legal currency. Coins issued by Royal Mint with a face value qualify as legal tender.

The two main choices are Gold Britannias and Gold Sovereigns. But The Royal Mint also produces more limited issue legal tender series such as Lunar coins and Queens Beasts.

These are the Royal Mint’s highest face value coin and weigh 1oz in weight. Gold purity is 999.9 / 1,000 parts gold and the most popular UK tax free coin for larger investors due to their low premiums. The 2021 version features high-tech laser produced security features, making it one of the most impressive bullion coins on the market.

Pre-owned Britannias are occasionally available and offer investors the chance of reducing premiums further. Britannias are also CGT free if bought in it’s fractional versions (half, quarter and tenth), or the silver version.

One of the world’s best known gold coins, the humble Sovereign also qualifies as tax free.

At around a quarter of the size of the Britannia, the Sovereign offers a more affordable route to gold for modest investors or more divisibility for those seeking flexible portfolios. The modern Sovereign has existed for more than 200 years, so it offers huge variety for investors and collectors alike. Best value Sovereigns offer the cheapest option, while historical editions from the Victorian era are more scarce, but expensive.

Half Sovereigns are slightly more costly per gram but appeal to those after smaller coins.

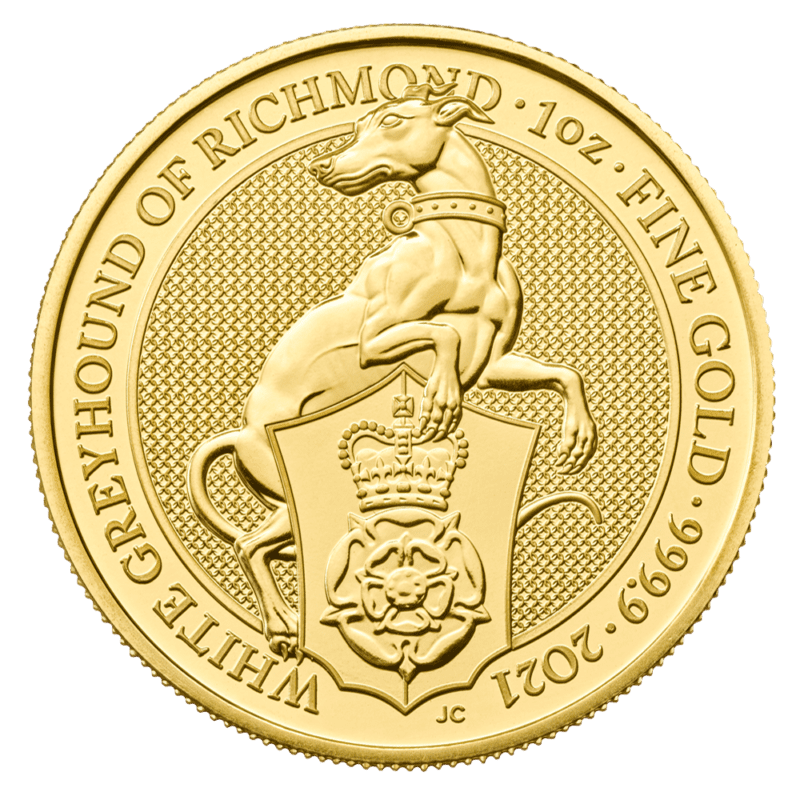

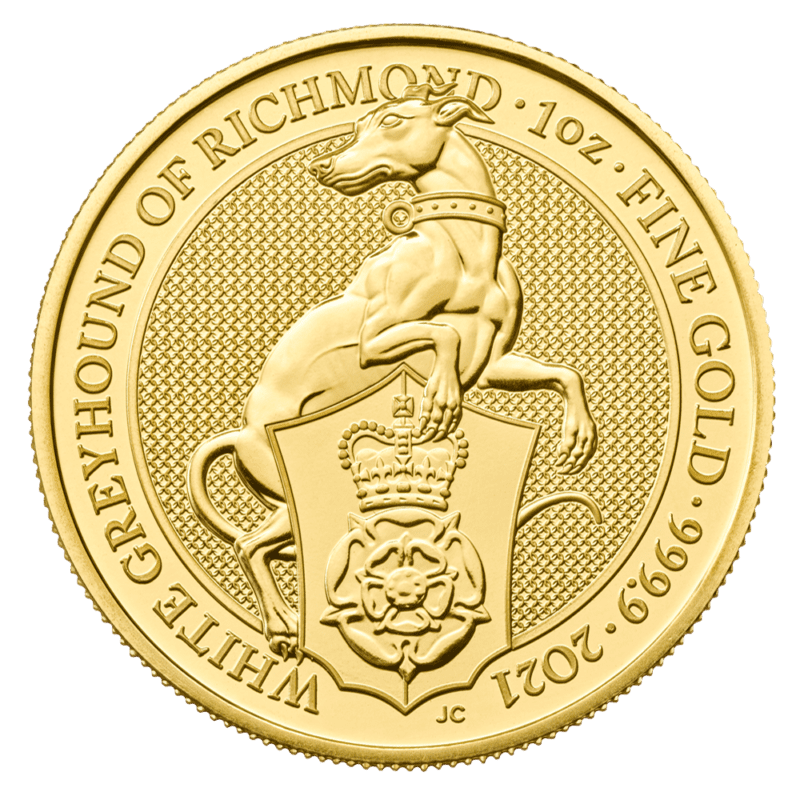

One of the most popular limited issue Royal Mint series is the Queens Beasts range of coins.

These are primarily 1oz 24 carat coins, although quarter ounce coins are also available. Limited to a series of 10, the coins’ stunning design is a major pull, but their limited issue quantity has also led to many of them increasing in value at a far quicker pace than other UK coins.

The White Greyhound of Richmond is the most recent and final issuance in the set. It currently trades at modest premiums, so could be a good bet if its value follows earlier coins upwards.

With the same £100 face value as Britannias, these coins also provide a tax free shelter.

Gold likely to offer high returns as a safe haven asset

With a lethal cocktail of high Government debt, increased taxes, high unemployment, recession, falling stock and property markets, weak currency and rock bottom confidence, 2021 and beyond looks like an economic nightmare.

But gold tends to benefit in these times, attracting investment from those seeking a safe haven. Indeed, gold has risen around 25% so far in 2020 as of mid-November. The previous gold bull run saw double digit rises every year from 2005 to 2011.

So gold isn’t just a way of shielding from capital gains tax, but also growing your savings.