Industry News

Trump Is Not Affecting Gold As An Investment

14 Nov 2016

Summary

- A Trump victory has been touted as a bullish sign for gold.

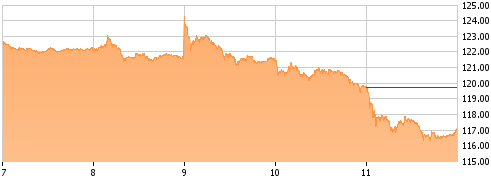

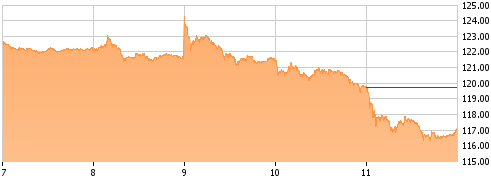

- The share performance of GLD does not bear this out.

- The Federal Reserve will have more bearing on GLD going forward.

The surprising victory of Donald J. Trump in the 2016 Presidential election over Hillary Clinton has generated plenty of speculation about what the next four years portend. For the World Gold Council, it is a bullish sign for gold. To quote the council’s global head of investment research, Juan Carlos Artigas:

Gold is the only de-facto currency that cannot be debased by printing more of it, and the only one that does not carry political risk. There is a reason why gold has outperformed every major currency throughout history.

The share price performance of the SPDR Gold Shares Trust (NYSEARCA:GLD) contradicts Mr. Artigas’ analysis.

The SPDR Gold Shares Trust is the world’s largest physically supported gold exchange-traded fund. According to the fund’s website, it holds $37 billion worth of gold assets, 934.56 tonnes and 30,047,142.09 ounces. Its market performance, therefore, is a telling indicator of gold’s value. And at $1,233 per ounce, gold is now at its lowest point since June.

Why has the price of gold dropped in the wake of Trump’s victory? Frankly, I do not believe that the outcome of the Presidential election has had much to do with gold’s performance. Precious metals in general have been in correction since the summer, and it seems the bottom has yet to be hit. A more pertinent factor affecting the price of gold is the potential for an interest rate hike when the Federal Reserve meet on December 14th.

Low interest rates make gold more attractive because there is no yield as there is with bonds or bond funds. Consequently, the only benefit that gold investors derive is capital appreciation. If there is an interest rate hike in December, as is expected, that will impact gold’s share price. This means that an attractive entry point for gold investors is being provided now, and may well be more attractive going forward.