Blog

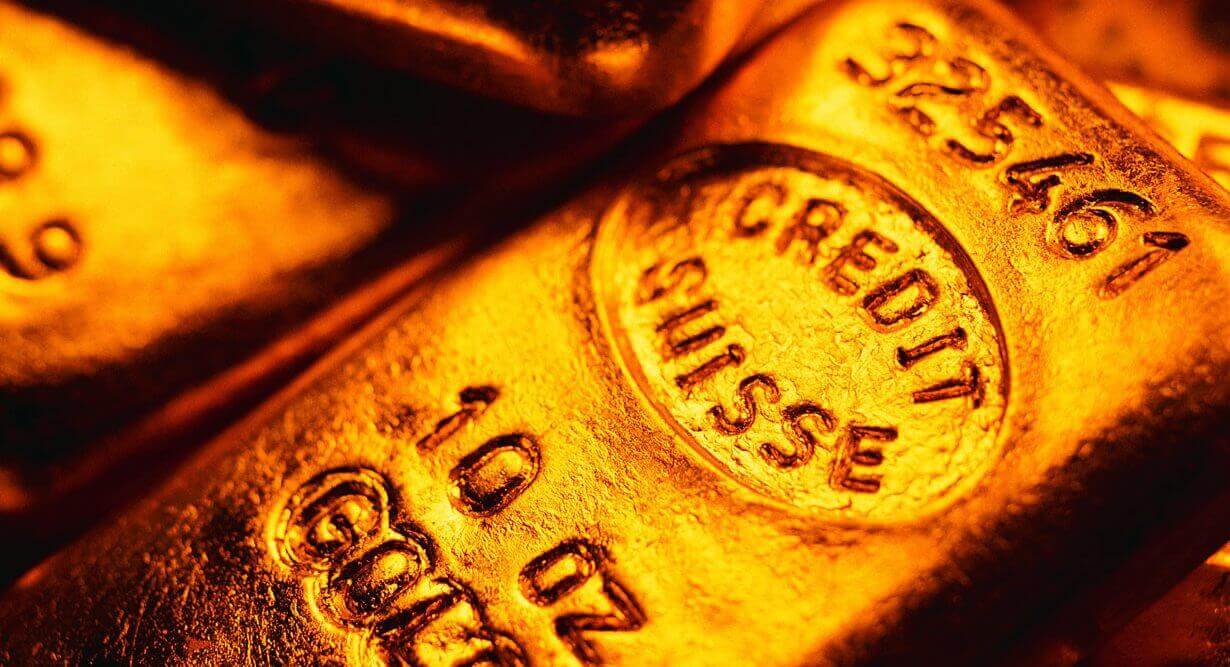

Physical Gold – 6 reasons it beats gold funds and ETFs

Gold funds or physical gold?

1. Security and Integrity

While ETFs have provided an accessible way for investors to gain exposure to the gold market there are many fears circulating about their security and integrity. For starters, the fact it is a structured paper asset that not everyone fully understands tends to defeat the object of owning a simple tangible asset like gold. So many investors have been stung over the past 5 years investing into asset-backed securities that were rated AAA by the credit rating agencies, only to see them downgraded to junk status overnight when everyone realised that the subprime mortgages they were linked to would not payout. It transpired that many very sophisticated investors never really knew which assets the bond was linked to or understood their lack of protection against such defaults. So are you more comfortable understanding the risks of holding gold coins or gold funds or ETFs?

Press reports are speculating that only 10% of the traded ETF value is backed by actual gold. With a distinct lack of auditing, it’s difficult to know for sure what the exact figure is.

Jefferey Christian of the CPM Group confirmed that gold is leveraged around 100:1 at a Commodities Futures Trade Commission (CFTC) Hearing on March 26, 2010. This means that there are around 100 claims for each ounce of gold in existence and so not enough gold to be delivered to everyone who has been promised paper gold.

So the question remains – would you be able to access the value of your ETF if half or more of the investors decided to withdraw at the same time?

Want your gold questions answered? Download our FREE Ultimate Guide to gold investment here

2. Counterparty Risk

The term counterparty risk has become far more used and relevant over the past few

We’ve seen bankruptcies to seriously major corporations from General Motors to Lehman Brothers. I saw many friends who had built up shares in Lehmans over many years of work and anticipated those stocks providing their retirement. No-one could have predicted that they would lose value so quickly and Lehman would go under.

We’re now seeing the next phase of counterparty risk with Sovereign debt. Investors who thought they were taking on very little risk by investing in Government bonds now face the very real prospect of not being paid out in full. Countries such as Ireland, Greece, Portugal and Spain need help from the EU and IMF to repay their debts. There is every chance that bondholders will not receive all the capital back.

With physical gold, there is NO counterparty risk. It doesn’t matter if a Government fails to repay bonds, a corporation goes bankrupt or even if the gold dealer you bought the gold from ceases trading. You will always have the physical asset to do with as you like.

By investing in gold mining stock, ETF or Gold funds – each poses some sort of counterparty exposure and a threat to the value of your asset. Remember – paper gold is a promise to pay, not the real thing!

3. Risk Profile

If you’re considering a choice between mining stocks and physical gold, it’s crucial to realise that these are different asset classes with entirely different risk profiles. Firstly, investing in mining stocks means your investment is linked to the performance of one company. As a paper asset, if that company underperforms, or even worse goes bankrupt, there is a chance that your investment becomes worthless. The value of gold coins and bars can never fall to zero or anywhere near because of the intrinsic gold content. During times of global economic turmoil mining stocks and bullion perform quite differently. Terror threats, currency depreciations, huge unemployment, record deficits and banking crises don’t provide conducive conditions for equity markets, which is why we’ve seen more and more people fleeing to the safety of gold bars and coins. Generally, while mining stocks have the potential for impressive returns they tend not to outperform physical gold during times of crisis such as the recent credit crunch. During sharp market declines such as the 1987 stock market crash, mining stocks become correlated to the broad equity markets rather than the price of bullion.

4. Comprehensive Insurance

If the reason you want to invest in gold is for portfolio insurance then make sure you have a Comprehensive policy! Everyone knows that gold provides security against economic and political unrest, making it the perfect safe haven asset in the current world in which we live. In that case, you want this wealth protection to be thorough. By investing in paper gold it’s like buying an insurance policy with get-out clauses. In other words, it doesn’t provide full coverage. There are still risks attached such as counterparty risk. By investing into physical gold, it’s like having the most comprehensive insurance available, putting your mind at rest that no matter what the next financial headline is, your physical gold holding will provide the necessary balance.

5. Tax Efficiency

In the UK, there is the opportunity to own physical gold coins which are completely tax-free. All investment grade gold is VAT exempt. You pay no income tax while holding the gold and UK coins such as the Britannia and Sovereign are Capital Gains Tax-free due to their status as legal tender. Compare this to paper gold such as a mining stock or gold funds where you’ll have to pay income tax on any dividends and capital gains tax if you sell the shares at a profit. With CGT now up to 28% for higher rate taxpayers, that’s nearly a third of your profits!

6. Accessibility

Accessibility in times of crisis is crucial. After all, gold should act as your crisis hedge. Over the past month, we’ve read about the attempted ‘ink-cartridge bombers’ and MI5 revealing renewed threats to the UK, France and Germany. The Eiffel Tower has been evacuated twice in recent months. If one of these attempts gets through and the financial system collapses for a week or so how easy is it to access funds through your gold ETF, mining shares or Gold funds? By holding the physical metal itself, especially in the form of globally recognised coins, you hold the ultimate liquidity.

Physical Gold is essential to any portfolio as a hedge. Thank you for explaining just how important it really is.