Gold Price Chart UK (GBP & Per Ounce Prices)

Here, we look at the underlying gold price. If you’re looking for gold charts, skip straight to section 2. This page is broken down as follows:

1) Gold Price – The Complete Insider’s Infographic

3) Gold price per ounce charts

4) Factors influencing the gold price

7) History

8) Why is gold more expensive than silver?

10) Currencies which the gold price is published in

Live Gold Sovereign Prices

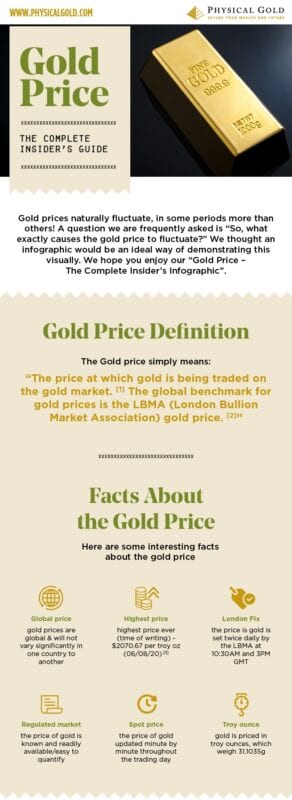

1) Gold Price – The Complete Insider’s Guide Infographic

As is often said “A picture paints a thousand words”, so we thought we would create an infographic, which summarises much of the information contained on this page. Learn all about the gold price in this visual infographic, which only takes 2-3 minutes to read. The image below is a thumbnail version only, but you can click this link to view the full-sized image in a separate window.

We hope you enjoyed this infographic and can see how a lot of information can be digested into just a few words. If you would like to view the infographic .jpg click this link and the infographic will be opened in a new page to view in its full size.

2) Price of Gold UK

The rising price of gold has been headline news in the UK for over a decade as the seemingly inexorable rise continues to match the highs of the 1980s. From reaching a 30 year low in 2001, the gold price per ounce has risen from around $360 to $1,825 in August 2011 and is currently trading at around $1,220.

Historically, the price has always been subject to some volatility but with a greater understanding of this valuable commodity, investors can use market knowledge to their advantage. Knowing when to buy gold, when to hold on to gold and when to sell gold is crucial to turning a profit but just what influences the gold price?

Find out how exposed your family are to plummeting stock and house price falls. Take our FREE test

3) Gold Price Per Ounce charts

You can find the historical prices of gold using our interactive gold chart below covering the last 24 hours (1D), previous seven days (1W) and for a period of one month, three months, six months, one year, two years, three years, five years and ten years.

4) Factors Influencing the Gold Price

Gold prices are one of the most complicated commodities, unlike other assets, the price is relative to more than just a typical production, demand and inventory algorithm. Even amateur investors can understand the correlation between traditional stock market data and the consequential shift in trading prices; however, because gold is effectively money, its price is also subject to additional influencers, namely:

- Global inflation, particularly that of the U.S., which indicates a rising supply of money;

Gold mining is a costly process and production is very responsive to market prices. Image via Khushie Singh (own work), Wikimedia. - The ‘indirect pricing’ of production costs for other commodities;

- Activities of central banks including printing money and their trading of gold.

- Real interest rates (interest rates compared to wages and inflation), particularly those in the U.S.

- Trade and growth imbalances.

In addition, influencing factors can be a combination of psychology, speculation and, to an extent, market manipulation.

The costs of extracting what gold is known to be left in the earth’s crust is an expensive business as much of this precious metal is alloyed with other metals making it harder (and more costly) to extract pure gold. As a result, the production of gold is incredibly responsive to market prices; if the gold price per ounce is too low then production slows or ceases. In turn, this means less gold on the market which causes the price to rise.

Live Gold Bar Prices5) The LBMA’s role

While the gold spot price fluctuates by the minute, the London Bullion Market Association (LBMA), provides two price fixes per day (10.30am GMT and 3 pm GMT) as reference points for the market. The London base for the association stems from the history of the gold stocks from the various global gold rushes being refined close to the Bank of England.

The Bank of England launched an approved list of producers who met the required standards in 1750, known as the London Good Delivery List, which still exists today.

The LBMA carries out several other rules including setting out a code of practice for LBMA members and publishing data including the amount of gold and silver in London vaults.

The most significant change recently has been with the publishing of the two daily price fixes for both gold and silver. Historically the am and ppm fix have been published minutes after the official fix. However, accusations of price manipulation by the big players who help set the price has led to changes in 2018. The LBMA now delays the publication of the daily fixes until the following working day to minimise any possible advantage of ‘fixing’ in a hope to eradicate any foul play.

The actual mechanics of price determination are through two daily electronic auctions for wholesale buyers and sellers of precious metals. An in-depth explanation of the auction process can be found here.

6) Currency influence (UK vs the US)

Due to its historical link to the US Dollar, the gold price is still to this day initially quoted in USD. This is fine as a benchmark to determine how the underlying price is faring.

However, when purchasing and selling gold outside of the US, currency exchange rates come into play. For UK investors, it’s actually the price in Sterling terms which is important.

And this is where it gets complicated!

Despite what many people say, Britain still

plays a significant role on the international stage. Its economy is still the 5th largest globally with its Gross Domestic Product (GDP) topping $3billion. Infact, it pushed France down a position as recently as 2014. Britain also has a very established international trade network so any rise or fall in our stock markets or currency will likely impact overseas investors. So, it makes sense that the price could go up if there’s either very poor economic data out of the UK which could impact the world stage, or political instability or international disputes affecting the UK. After all, gold is a hedge against traditional fiat currencies, so it should rise when a major fiat currency falls.

However, with Britain increasingly shrinking when compared with the growth of the emerging economies such as China and India, negative news in the UK tends to have a limited impact on the $ gold price. Only when the news is more international, perhaps the UK joining the US in airstrikes in the Middle East, will the underlying price benefit.

So, Sterling can be ignored?

Not at all. As a UK buyer or seller of gold, Sterling plays a huge role, but indirectly. As the Pound weakens against the Dollar, the gold price increases in the UK. That’s simply the effect of the gold price being converted at a higher rate (weaker Pound) from Dollars into Sterling. So, the general rule of thumb is, the price of gold in the UK goes up when the Pound weakens (against the Dollar) and it declines when Sterling strengthens against the Dollar. The problem arises when bad news in the US can weaken the Dollar, pushing gold up in $ terms, but at the same time, the Dollar falls against Sterling, pulling the gold price UK back down. It’s impossible to know which factor will push or pull the hardest!

Live Sell Gold Prices7) A Market History

Over the last ten years, gold prices (whether this is in gold coins, gold bars or gold bullion) have risen from around $664 per ounce to around $1,220; that’s an increase of 83.73%. At the height of the recent market, the gold price per ounce reached $1,825 or increased by 174.85%. Investors who chose to liquidate their assets in August 2011 would have realised a large profit on their original gold investment; but, did many choose to do so?

Probably not and there is a good reason for this. Investing in gold, for many people, is not about turning immediate profits and constantly analysing markets to liquidate their assets. Gold is seen as a way of diversifying a portfolio to mitigate the risk of the kind of market exposure offered only by paper assets. For many, this kind of investment decision is about shoring up a pension or other future financial retirement annuity.

Historic prices, like other commodities, have followed wider economic trends as well as geopolitical changes. Most significantly, as a form of money, gold is strongly linked to the currency markets, notably the US Dollar. A weak US Dollar is often a precursor to a higher price whilst a strong US Dollar can indicate a fall in the gold prices.

8) Why is Gold More Expensive than Silver?

Quite simply, gold is a much rarer metal than silver though silver is becoming more widely acknowledged as a diminishing precious metal which is causing the price of silver to rise. Silver investment is, therefore, being adopted by many investors due to the current low entry price point coupled with the potential rate of growth.

At a simple supply and demand level, gold is one of the rarest elements on our planet. It is estimated that if all of the gold ever mined was melted down and stored in one place, it would only fill one Olympic sized swimming pool. The gold price per ounce reflects this scarcity in the same way that works by artists like Da Vinci and Picasso are valued; limited in supply but high in demand.

9) Gold coins and bars

If you want to know the price of gold coins or bars, then a few other factors have to be considered. Here are the factors you need to consider:

- Firstly, start by determining the spot price for gold in the currency you wish to transact. So, for example in the UK, the price may be £1,000 per ounce or £32.15 per gram. This isn’t the price at which you can buy or sell physical gold but instead acts as a benchmark to calculate the price of golds coins and bars.

- Next, you need to convert to the size of your coin or bar. So, for a 100g gold bar, the quickest method is to multiply £32.15 per gram by 100 = £3,215. Or for a Sovereign coin, you can multiply £32.15 per gram by 7.32 (as this is its pure gold weight) = £235.34.

- However, this is their spot rate equivalent. When buying coins or bars,

there’s then a premium to add. The size of this premium will include the production and distribution cost, the dealer’s fee, the number of items you’re purchasing and finally any historical value. Generally, production cost will be smaller as a percentage, the bigger the piece of gold, and vice versa. In other words, it’s far less significant on a 1kg gold bar worth £30k than a 5g gold bar worth (£175). Dealers also incentivise the buyer to purchase larger quantities by reducing their margin with the more that are bought. So, it’s worth trying to buy as much gold at once as possible to reduce this charge. You’ll need to do the maths on whether it’s better value to buy gold bars as 1 x 1kg or 10 x 100g. Usually, 1x1kg will be slightly cheaper but offers no flexibility for partial sales.

Finally, the age of the coins may well push up their price as they command a higher premium due to scarcity, desirability and collectability. For instance, a brand new Sovereign coin may well cost £245, while the value of a Victorian gold Sovereign could be as high as £310! It’s the same amount of gold, just worth different amounts (up to 30%). Old gold bars do not command a similar premium as there’s little to distinguish old bars from new.

4. The gold finish will also impact the price of gold coins (such as Britannias). Bullion finish is the cheapest finish for coins and appeals for those looking for investment value. A proof finish coin is struck up to 3 times and takes longer to produce. We describe the difference in look as comparing standard definish TV to Ultra high definition. The Proof coins have a matt portrait and shint background, making the whole image look more 3 dimensional. This is fine for collectors, but the difference can be as high as 30%, especially as many proof coins come in presentation boxes and in limited issue. Most mainstream UK coins are produced to both finishes, so we’d recommend sticking with bullion versions to keep the gold price down, especially as dealers won’t pay you the same premium when you sell proof coins.

10) Currencies Which the Gold Price is Published In

The gold price is often quoted in US Dollars but is also priced in many currencies, which are summarised below:

- Principle global currency – US Dollars

Other published currencies:

- Australian Dollars

- British Pounds

- Canadian Dollars

- Euros

- China – Onshore and Offshore Yuan

- Indian Rupees

- Japanese Yen

- Malaysian Ringgit

- Russian Rubles

- Singapore Dollars

- South African Rand

- Swiss Francs

- New Taiwan Dollars

- Thai Baht and

- Turkish Lira

Contacting Physical Gold

Here at Physical Gold, we are not financial advisers and cannot give you specific advice on the best time to buy and sell your gold, irrespective of the prevailing gold price per ounce. What we can do is support your decision to invest in, or liquidate, precious metals and get you the best price for your trade. Why not call us on 020 7060 9992 or complete our contact form to get in touch?

We can also provide you with the latest gold price charts and insights affecting gold in the UK with our market news, information and tips blog.