Industry News

World Gold Council – Investment Update: Gold tracks the dollar as rates take a back seat

Investors often use the direction of the US dollar as a bellwether for gold’s performance. However, over recent years, short-term movements in gold have been more heavily influenced by US interest rates and expectations of policy normalisation. Our analysis shows that the correlation between gold and US rates is waning and that the US dollar is again a stronger indicator of the direction of price. And, in our view, this will continue over the coming months – even while the dollar won’t explain gold’s movements entirely. Furthermore, the analysis shows that higher real rates have not always resulted in negative gold returns.

Linking gold, the US dollar and interest rates

There is no one single driver of the price of gold. Generally, gold’s price drivers can be grouped into four categories:

1) wealth and economic expansion; 2) market risk and uncertainty; 3) opportunity cost, and 4) momentum and positioning (see page 3).

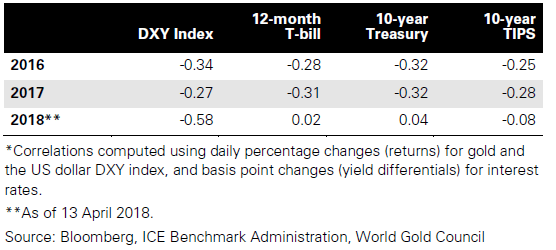

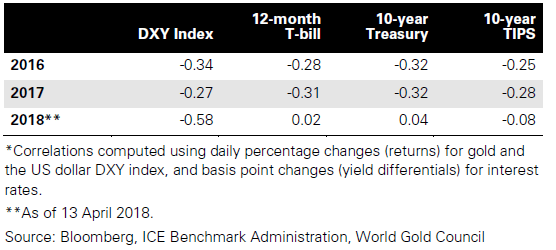

Table 1: The influence of US rates on gold has fallen behind that of the dollar

Correlations between gold, the US dollar, and various interest rate benchmarks*

In the short and medium term, two variables attract investors’

Yet, gold continues to trend higher – increasing by 8.5% since the Federal Reserve rate hike in December 2017 – despite interest rates rising at an accelerated pace. A key question for investors is, therefore, what matters more – the direction of the US dollar or the direction of interest rates? The answer is, generally, the US dollar. But there are exceptions to this rule.

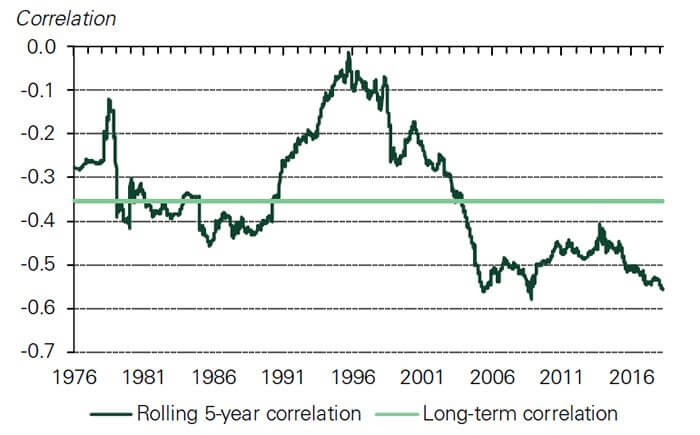

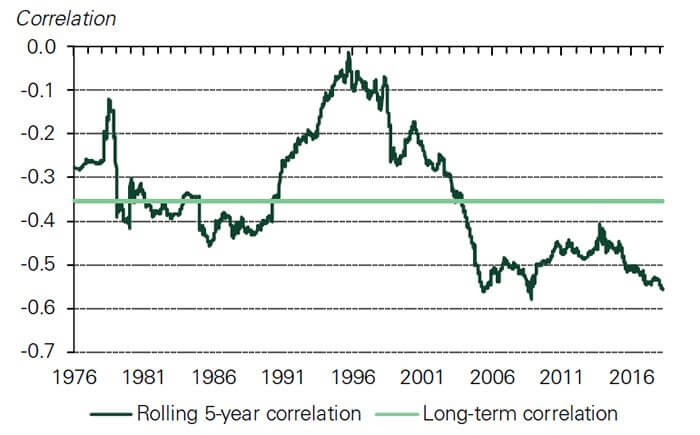

Chart 1: There is a consistently negative correlation between gold and the US dollar

Correlation between gold (US$/oz) and the US dollar real exchange rate*

Source: Bloomberg, ICE Benchmark Administration, World Gold Council