Industry News

World Gold Council – Enhancing The Performance of Alternatives with Gold

In recent years, buy-and-hold investors such as pension funds, endowments, insurance companies, and sovereign wealth funds have gradually increased their investments in alternative assets to diversify their portfolios and boost returns.

‘Alternatives’ make up 23% of SWF portfolios and

Alternatives can offer attractive returns but be highly correlated to the stock market during downturns and often require long holding periods. Our research suggests that gold can complement alternatives by providing returns, improving diversification, adding liquidity, and enhancing overall portfolio performance.

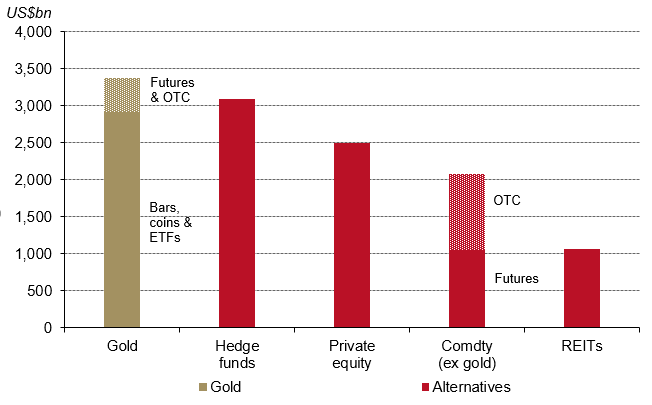

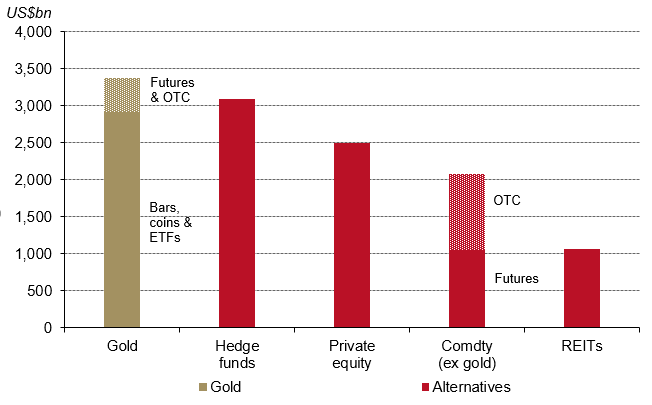

The financial gold market is larger than the size of many alternative assets

The estimated size of alternative assets*

*Based on most recent available data on each market as of December 2017.

Source: Barclays, BIS, JP Morgan, Preqin, REIT.com, World Gold Council