Industry News

The gold price jumped this year – is it now too late for investors to buy in?

2016 has been a year of heightened uncertainty. Brexit, the US presidential election, and ambiguity over when interest rates will rise are just a few factors that have caused concern. In environments such as this, investors generally seek ‘safer’ investments.

Cash or government bonds are often the go-to option. However, in recent years, the interest paid on these investments has fallen close to zero. With inflation (0.5%) at a higher level than the Bank of England base rate (0.25%), money in the bank could be falling in value in terms of its spending power. In addition, governments and central banks across the world have the ability to take interest rates into negative territory. This has already occurred in Japan and Europe, for example, which reduces the attractiveness of cash even further. Elsewhere, in response to the increased quantitative easing programme in the UK, government bonds currently yield close to 0.6%, so also offer little real income. Meanwhile, a third safe-haven investment – gold – has increased in popularity and risen strongly this year.

Gold – a perfect storm

There is a fixed amount of this precious metal in the world so central banks are not able to manipulate the gold market like they can with bonds and cash. In the current environment of quantitative easing and increasingly extreme monetary policy, gold is highly sought after.

Historically, the non-yielding nature of gold made it less attractive than income-producing cash or bonds. However, with interest rates and bond yields so low, investors no longer face the dilemma of shunning income in favour of holding gold. As the gold price moves independently to the performance of shares and bonds, it is also popular with investors looking to add diversification to their portfolio.

Gold has become more attractive to investors at a time when gold companies have begun to feel the benefit of their cost cutting and efficiency-improvement initiatives. Reduced debt and capital expenditure means any rise in the gold price potentially feeds through to profits, and therefore the dividends these companies pay. In addition, many gold companies pay their costs in local currencies such as the South African rand and Canadian and Australian dollars, but receive revenue in US dollars, so have benefitted from recent dollar strength.

In cutting costs, many miners cancelled up-coming projects. This has led to plateauing mine production and limited gold discoveries, which has dampened new supply. Meanwhile, demand for gold is on the rise. Asia’s growing middle-class, particularly in India, use the precious metal to store their wealth, while Chinese investors, who are restricted in the amount they can invest outside their borders, have looked to gold for diversification as both Chinese equities and bonds have struggled of late. Limited supply alongside growing demand serves as a boost to the gold price.

Performance of gold verses gold mining companies

While there is some link between the gold price and the fortunes of gold mining companies the performance of the latter in recent years has highlighted their increased risks. Mining companies are affected by a range of factors in addition to the price of gold, including management decisions and the costs associated with finding and producing gold. Many gold mining companies let costs spiral and were hurt by the weaker gold price between 2011 and late 2015. Since early 2016, the gold price has risen strongly and gold companies, now leaner following their cost cutting and efficiency-improvement initiatives, have benefitted strongly. While an investment in gold mining companies will give some exposure to the gold price, they are not the ‘safe haven’ investment that physical gold is. Investments will fall as well as rise in value so investors could get back less than they invest.

BlackRock Gold & General Fund

The BlackRock Gold & General Fund invests primarily in companies that mine for precious metals, and invests very little in physical commodities. The fund currently has its highest level of gold exposure since 2009 as the manager, Evy Hambro, expects the above trends to drive the gold price higher still. The portfolio is focused on companies capable of growing to improve their economies of scale. This includes businesses moving against the grain to invest while the rest of the sector cuts back on production, and those engaging in merger and acquisition activities. A current example is Canadian producer TMAC, which has purchased a new mine from Newmont that will increase their production capabilities. The company also benefits from a strong management team, according to Evy Hambro.

The manager favours quality companies with established mines and strong balance sheets, as he believes they perform better over longer timeframes that include periods of both a falling and rising gold price. This bias to quality companies has led the fund to underperform its peers since the gold price began to rise in January this year as they have lagged their lower-quality counterparts.

Barrick Gold, for example, is the largest gold producer in the world and accounts for a large part of the index but only a small part of the fund. This has hurt performance as investors have flocked to this company as an obvious way to gain access to the sector, driving the share price 57% higher over the three months to end of June. However, as the manager feels the company is of poor quality and overvalued, he has not increased the fund’s exposure.

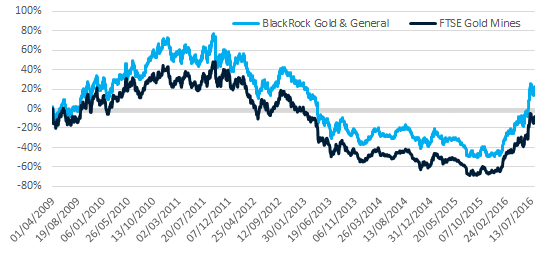

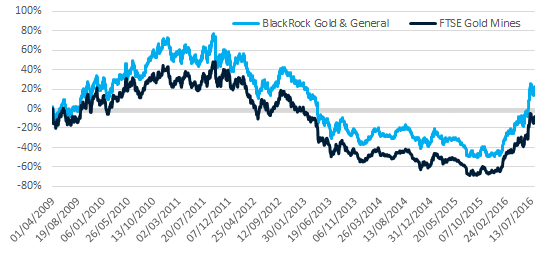

Exposure to higher-quality companies over the longer term has aided performance. The fund has tended to lag in periods of falling share prices but shelters investors from the worst of price falls. Evy Hambro has managed the fund since April 2009 and over his tenure, the fund has risen 22.7% compared to a loss of 8%* for the FTSE Gold Mines Index over the same period. Recent performance has been particularly strong, with the fund returning 130%* since the beginning of this year, compared with a rise in the gold price of 40%. However, this period of strong performance has not yet recouped the losses of the five years prior and should not be seen as a guide to future returns. The portfolio is relatively concentrated which allows each holding to have a significant impact on performance although this is a higher-risk approach.

Performance of the BlackRock Gold & General Fund over manager’s tenure

Source: Lipper IM to *1 August 2016.

Past performance is not a guide to future returns.

| Annual percentage growth | |||||

|---|---|---|---|---|---|

| August 11 – August 12 |

August 12 – August 13 |

August 13 – August 14 |

August 14 – August 15 |

August 15 – August 16 |

|

| FTSE Gold Mines | -23.67% | -38.45% | -7.32% | -42.05% | 185.7% |

| BlackRock Gold & General | -23.67 | -38.67% | -5.79% | -33.69% | 136.21% |

Past performance is not a guide to future returns.

Our view

Over the long term, gold mining shares have been one of the most volatile places to invest. Gold could continue to do well if uncertainty prevails and investors continue to seek ‘safe-haven’ investments. However, we would only ever suggest allocating a small portion of a portfolio to such a high-risk sector.

The BlackRock team is experienced and well-resourced and their long-term track record is strong. This is a specialised fund with exposure to emerging markets and smaller company shares, both of which increase risk. We believe the fund manager should add value for investors over the long term and the fund retains its place on the Wealth 150 list of our favourite funds across the major sectors.