Blog

How Much is a Kilo of Gold Worth?

Spot prices of gold

The spot prices of gold change each day on the international commodities markets. These prices of gold are set by the COMEX exchange in New York. These prices remain prevalent through that day. Indeed, like all other commodities, these prices vary due to a number of factors. Of course, one of them is supply and demand. In 2017, the total amount of gold produced was 3.15 thousand metric tonnes. In contrast, this figure was 2,470 metric tonnes in 2005.

The fluctuating demand for gold

The demand for gold, however, is not dependent merely on supply and demand. Like all precious metals, gold is a lucrative asset class that investors turn to in times of turmoil in the international capital markets. For example, the current imminent trade war between China and the US has already seen several risk-averse investors move their money to gold.

Download our FREE 7 step cheat sheet to successful gold investing here

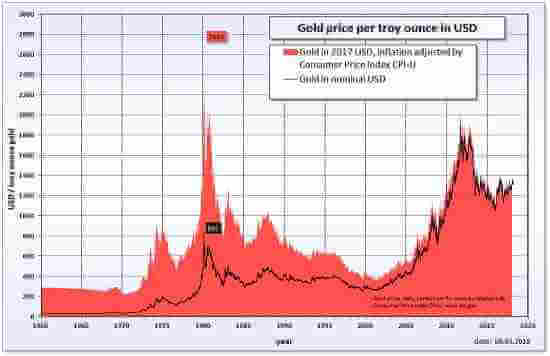

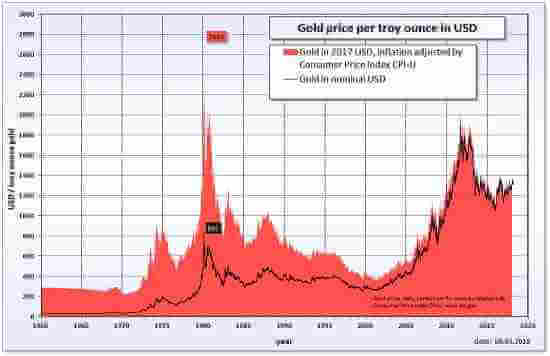

Gold prices, therefore, are dependent on macro-economic factors such as economic stability around the world, geo-political triggers such as terrorist action and wars, as well as seismic shifts in the international capital markets. If we study gold prices over the last ten years, we can see that the spot price skyrocketed to $1900 levels in August 2011. This was a huge surge from 2008, only three years back, when gold was $869.75.

Volatility in gold prices

This meteoric rise of gold in just 3 years was largely due to the bubbling global financial crisis, which eventually saw the stock markets implode on August 8, 2011, commonly known as Black Monday 2011. But, again the fall of the stock markets at the time was not an isolated event in itself. It was a knee jerk reaction by paranoid investors pulling their money out of the beleaguered US economy, as a result of the US debt ceiling crisis. The American national debt basically spiralled out of control, with Standard and Poor downgrading the AAA rating for the US economy.

During every crisis over the last 20 years – the dotcom bubble, the 2008 US sub-prime debt crisis and the 2011 crisis, investors turned to gold to hedge their risks. So, we can see that the prices of gold react heavily to the economic environment at large. Even inflation is a driving factor, as is the weakening of the US dollar or the pound. However, in the middle of all the ups and downs, gold has steadily become dearer over the decades. The word ‘decades’ is an important thing to note here. As a savvy gold investor, you have to be able to take a long-term view. If you want to extract value from the precious metal, you need to remain invested over a ten or twenty year period. It’s not the kind of game, where you can make a fast buck, get in or out. Investors who have a speculative approach to investing aren’t going to extract value out of gold.

So, how much is a kilo of gold?

So, to answer our initial question – how much is a kilo of gold worth?

Call us to find out more about buying gold

At Physical Gold, we pride ourselves on being a reputed online broker and giving investors a fair deal. We have many types of gold that we sell. Please call us on 020 7060 9992 or contact us via email to get in touch with a member of our investments team. We are always happy to discuss your investment goals and advise you on the best gold products to buy.

Image credits: Wikimedia Commons and Wikimedia Commons